Hey everyone —

It’s Alberto here. Hope you’re having an awesome weekend.

Let’s get into it — because this week’s edition might be one of the most important we’ve written.

We’ve been getting dozens of messages asking:

“Why does it feel like VC is disappearing?”

The truth?

Classic VC is on life support.

But that’s not a bad thing. It’s good news — if you know what to do next.

Let’s talk about what’s happening, what the top firms are really doing, and where the biggest opportunities are.

Feeling Off Lately? Try One Week of Therapy, Free

Life can be overwhelming, but getting support shouldn’t be. This May for Mental Health Awareness Month, BetterHelp is offering one week of therapy completely free, so you can experience what real support feels like—no cost, no pressure.

You’ll be matched with a licensed therapist in as little as 24 hours, and connect on your schedule—by phone, video, or chat. With 35,000+ professionals, there’s someone for you. 94% of BetterHelp users report feeling better after starting therapy, and now you can try it yourself, risk-free.

💀 What’s Really Going On with VC?

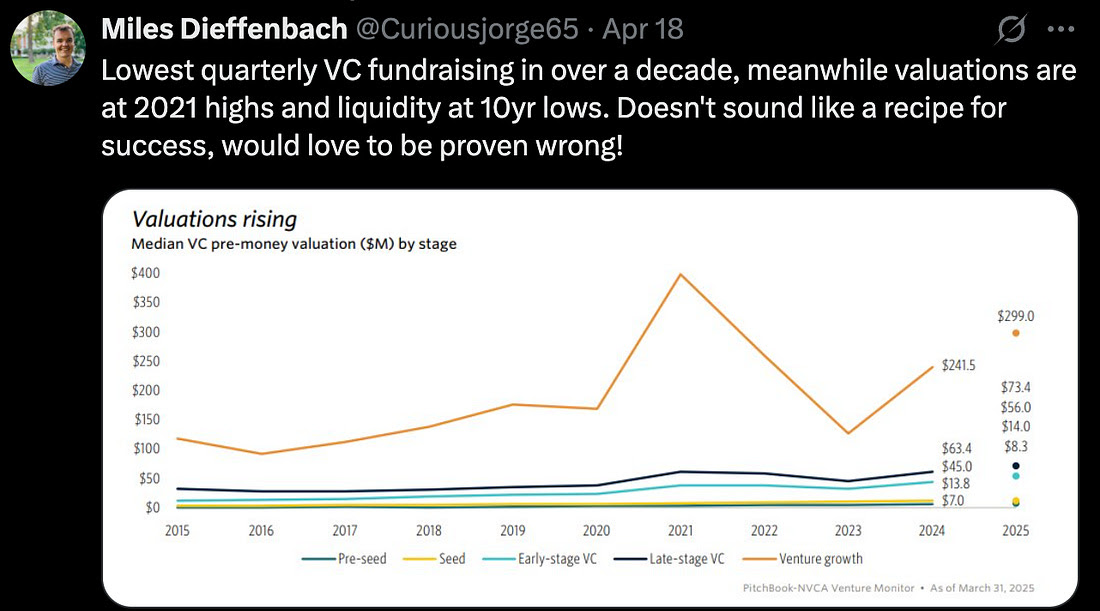

Let’s get the numbers out of the way:

According to Pitchbook, venture capital fundraising in Q1 2025 hit one of the lowest levels in the past decade.

📉 Exits are drying up.

📉 LPs are nervous.

📉 New fund managers are struggling to raise.

And yet… valuations are still sky-high (thanks, AI hype). There’s tons of dry powder, but very little liquidity.

In short:

Money is sitting still. Confidence is shaky. And patience is running out.

But here’s the twist:

The best VCs aren’t slowing down.

They’re reinventing themselves.

Alte

⚙️ Top VC Firms Are Becoming Builders

Let’s walk through what the real titans of venture capital are doing right now:

💼 Lightspeed Ventures

They just registered as an RIA (Registered Investment Advisor). That means they can:

Buy public stocks

Do buyouts

Roll up companies

Operate like a private equity firm

This isn’t a side hustle. It’s a pivot.

Lightspeed Venture Partners just became a Registered Investment Advisor (RIA).

🧠 a16z (Andreessen Horowitz)

They’ve been on this path since 2019:

Built a crypto empire

Launched a wealth management division

Participated in the Twitter buyout

Became a full-stack content + capital platform

They look more like SoftBank meets Blackstone than a classic VC.

a16z made the RIA move back in 2019. Since then, they’ve launched a wealth management arm, jumped into the Twitter buyout, built a massive crypto operation, and started behaving more like a governance-heavy PE firm than a typical VC.

A16z Wealth Management Division

🌲 Sequoia Capital

They killed the traditional 10-year fund structure.

Replaced it with a single, evergreen vehicle — so they can hold positions long-term and move like an institutional operator.

General Catalyst?

🏥 General Catalyst

Not even calling themselves a VC anymore.

They acquired a hospital system, built AI companies in-house, and started calling themselves a “transformation company.”

Yes, really.

Thrive Capital la

🤖 Thrive Capital

Launched a $1 billion+ platform to build AI-first companies — not just invest in them.

They’re hiring operators, not just analysts.

🚨 So, Is Venture Capital Dead?

The answer is nuanced.

Traditional VC — the “write a check, sit on the board, hope for an IPO” model — is dying.

But what’s replacing it is smarter, faster, and way more exciting.

We’re seeing:

The merge of VC and private equity

More founder-operator investor teams

Faster liquidity from secondary markets

Funds acting like startups themselves

And a huge opening for new models

Which brings us to the big question…

🔍 What Should You Do About It?

If you’re an investor:

Stop waiting for a pitch deck in your inbox.

Start looking for founders who can build ecosystems — not just MVPs.

Look at firms acting like acquirers, not spectators.

If you’re a founder:

You don’t need 1 partner writing a big check.

You need 1,000 believers writing small ones — then telling their friends.

The future of capital raising will come from audience + access + action.

And we’re building for that future right now at Founderscrowd.

🎯 TL;DR

Big VCs are morphing into PE-style platforms

Rollups, buyouts, evergreen funds, and in-house builds are the new playbook

The old playbook is gone — and that’s your advantage

You can participate, not just watch

Thanks for being here — and for being part of a new era of investing.

We’ll be back Wednesday with a breakdown of what separates signal from noise in early-stage startups (and how to spot red flags faster than most angels).

Until then, keep learning, keep asking questions, and keep betting on the underdogs.

With you all the way,

Alberto

Founder, Founderscrowd