It’s Alberto here, and today we’re diving into a topic that can completely transform how you approach startup investing—how to analyze early-stage startups like a seasoned pro.

When it comes to investing in early-stage startups, you’ve got to know what to look for. Most people think it’s all about luck or timing, but the truth is, successful investors are great at identifying the key factors that make a startup worth backing. Whether you’re investing through Founderscrowd or making your own decisions, these tips will help you understand how to evaluate a startup’s potential and reduce the risk of investment.

Let’s break it down!

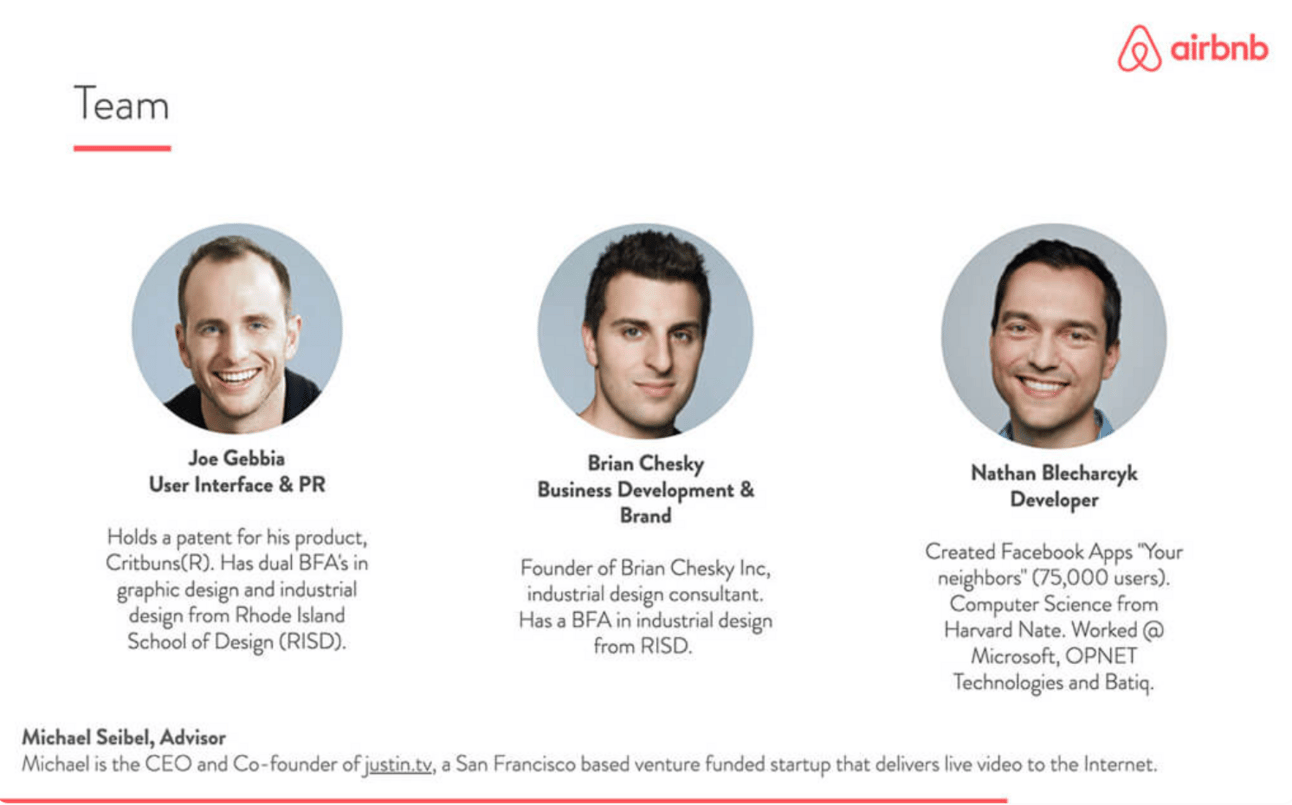

1. Team: The Founders Are Everything

It’s often said that “the team is the company.” And while the product and market fit are important, the founders and team are the true heart of a successful startup.

Here’s what you should look for:

Founders’ Experience: Have they built a company before? Do they have relevant experience in the industry they’re tackling? A repeat founder often brings invaluable lessons from past successes (and failures).

Passion and Drive: Is the team passionate about their idea and problem they’re solving? Passion can be a driving force when things get tough.

Complementary Skill Sets: The best teams often have diverse skills—you need technical expertise, business acumen, and marketing skills all working together.

If the founders are motivated, experienced, and have a track record, the team can usually pivot and adapt as needed, which is a major factor in long-term startup success.

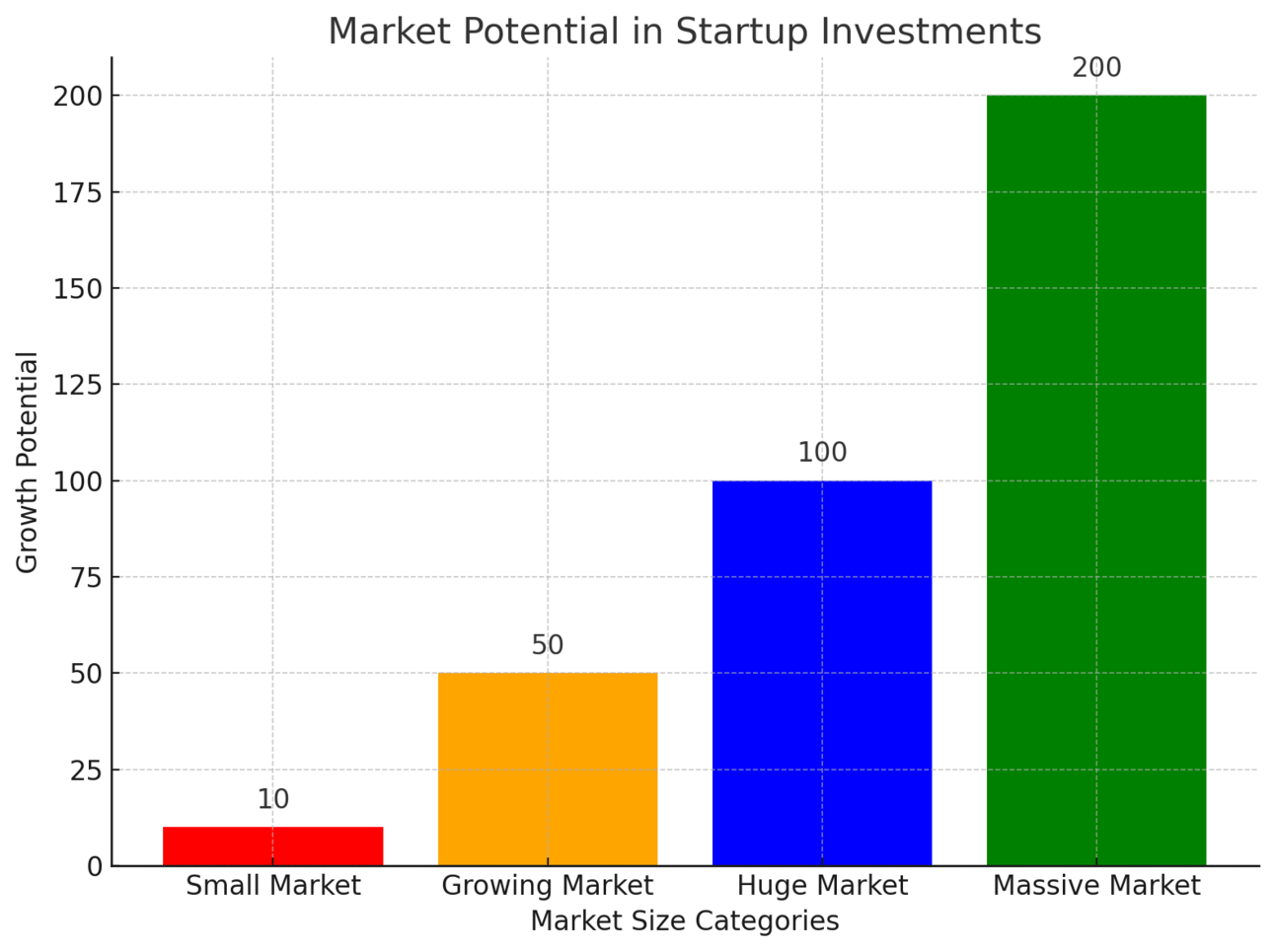

2.Market Potential: Is the Opportunity Huge?

You could have the best team, but if the market isn’t big enough or growing fast enough, the startup will struggle. Always ask yourself:

How big is the market? Look for a total addressable market (TAM) that is large and rapidly growing. Startups in expanding markets have the best chances of scaling fast.

Is the market underserved? A startup that solves a pressing problem or improves on an existing solution has a huge advantage.

Competitive Landscape: It’s important to know who the competitors are. But a founder with a unique angle can differentiate and capture market share even in a competitive space.

The key here is to research the market size and growth projections. An investor should be looking at companies in markets where the potential for growth is massive.

3. Product-Market Fit: Does the Product Solve a Real Problem?

It doesn’t matter how talented the team is or how big the market is if the startup doesn’t have a product-market fit. Here’s how to evaluate if they have it:

Customer Feedback: Are customers raving about the product? Look for early adopters and feedback that suggests the product solves a real pain point in the market.

Retention Rates: High retention is a sign that users not only try the product but also continue using it. If customers come back, it’s a good indicator that the product is really working.

Product Growth: Has the product evolved from its initial version? Successful startups typically start with a minimum viable product (MVP) and iteratively improve based on user feedback.

If the startup is constantly improving its product and there’s clear evidence that users love it, it’s a good sign they’re on the right track.

4. Traction: Early Indicators of Success

Startups that have some early traction—even if it’s small—are much more likely to succeed than those who have little to no progress. Here are a few things to look for:

User Growth: Is the startup gaining new users quickly? Look at early adoption rates—startups that are scaling their user base rapidly have a higher chance of success.

Revenue Growth: While some startups might not be profitable at first, early revenue is a good indicator of product-market fit. Even if they aren’t profitable yet, growth in revenue shows that they are on the path to profitability.

Partnerships and Media Attention: Are they partnering with key players in the industry or getting noticed by the media? Positive press and strategic alliances can provide momentum for future growth.

Traction is the clearest sign that the startup is moving in the right direction. If they have early proof of concept, it reduces risk for investors and increases the likelihood of long-term success.

5. Exit Potential: How Will You See a Return?

As an investor, you want to know how you’ll eventually see a return on investment (ROI). There are a few key things to consider:

Acquisition Potential: Is the startup in a sector that might be attractive to larger companies looking to acquire? For example, tech startups often get acquired by bigger companies seeking innovation.

IPO Potential: Does the startup have growth potential that could lead to an initial public offering (IPO)? Many investors dream of seeing their investments go public for a huge payout.

Exit Strategy: Do the founders have a clear exit strategy in mind? Whether it’s being acquired or going public, knowing how they plan to scale and exit helps you evaluate the risk.

Knowing the exit plan gives you clarity on how your investment could pay off and what the timeline might look like.

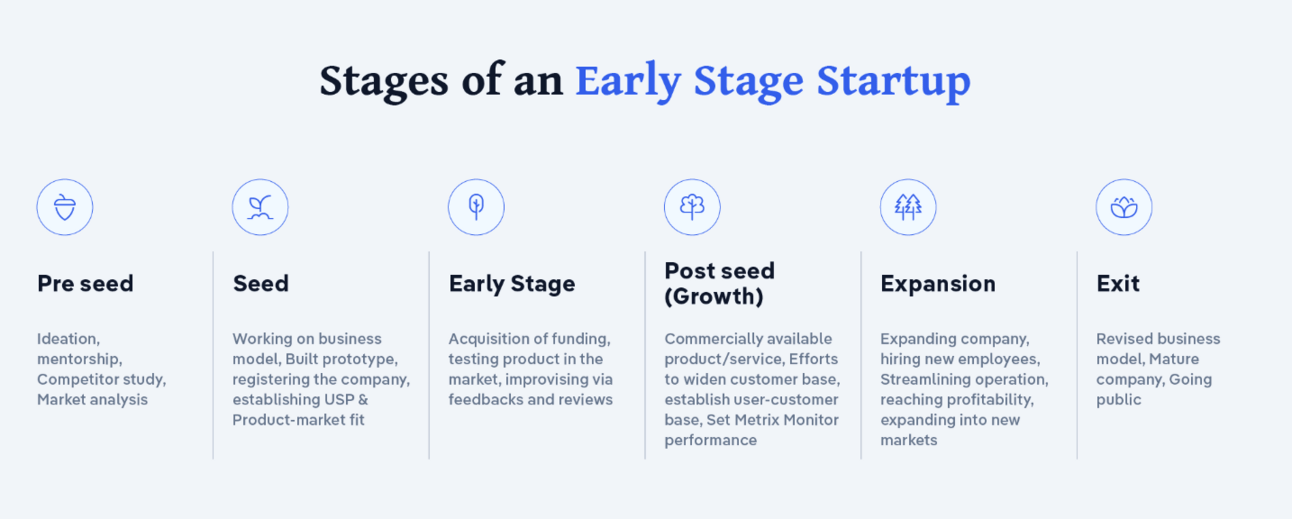

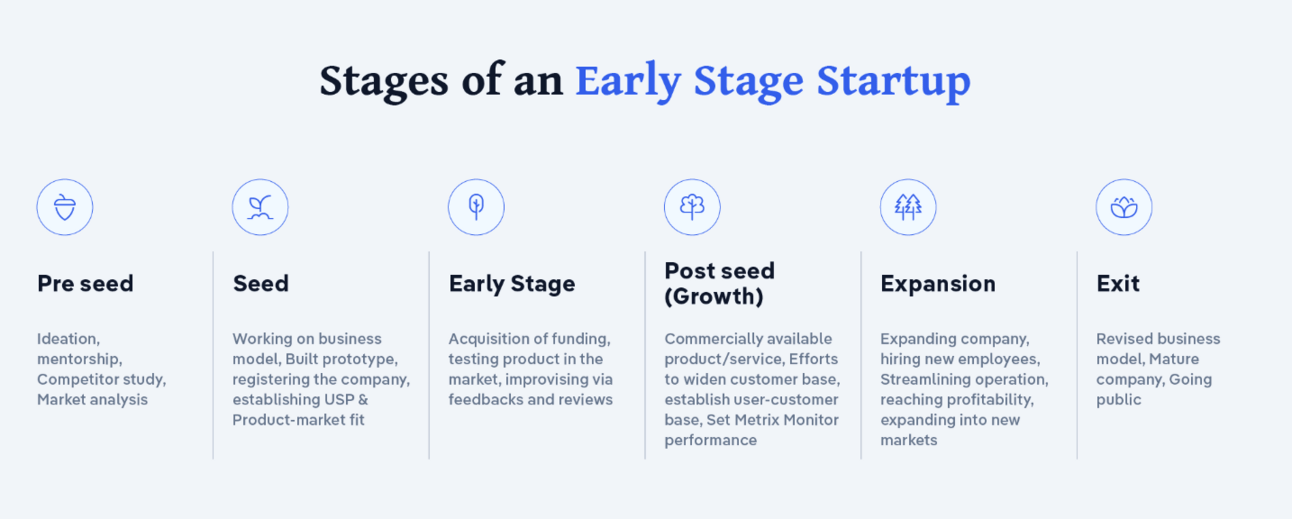

How to Analyze Early-Stage Startups Like a Pro

Investing in early-stage startups isn’t just about looking for the next big idea—it’s about understanding the key factors that contribute to long-term success. Team, market potential, product-market fit, traction, and exit potential are all vital components to analyze before jumping in.

At Founderscrowd, we make it easier to access game-changing startup opportunities and help guide you to the next unicorn.

This Week's Sponsor: The Rundown AI

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

Next Steps for Investors:

If you’re ready to start analyzing startups like a pro, then keep an eye on Founderscrowd for upcoming investment opportunities. As always, I’m here to help guide you on your journey to smarter investing and financial growth.

If you are currently raising capital reach out.

Cheers,

Alberto

CEO, Founderscrowd

Helping You Find the Next Big Thing in Startups.