Hey there,

It's Thursday, and I'

ve got something wild to share with you.

⏱️ Read time: 3 minutes

When Is the Right Time to Retire?

Determining when to retire is one of life’s biggest decisions, and the right time depends on your personal vision for the future. Have you considered what your retirement will look like, how long your money needs to last and what your expenses will be? Answering these questions is the first step toward building a successful retirement plan.

Our guide, When to Retire: A Quick and Easy Planning Guide, walks you through these critical steps. Learn ways to define your goals and align your investment strategy to meet them. If you have $1,000,000 or more saved, download your free guide to start planning for the retirement you’ve worked for.

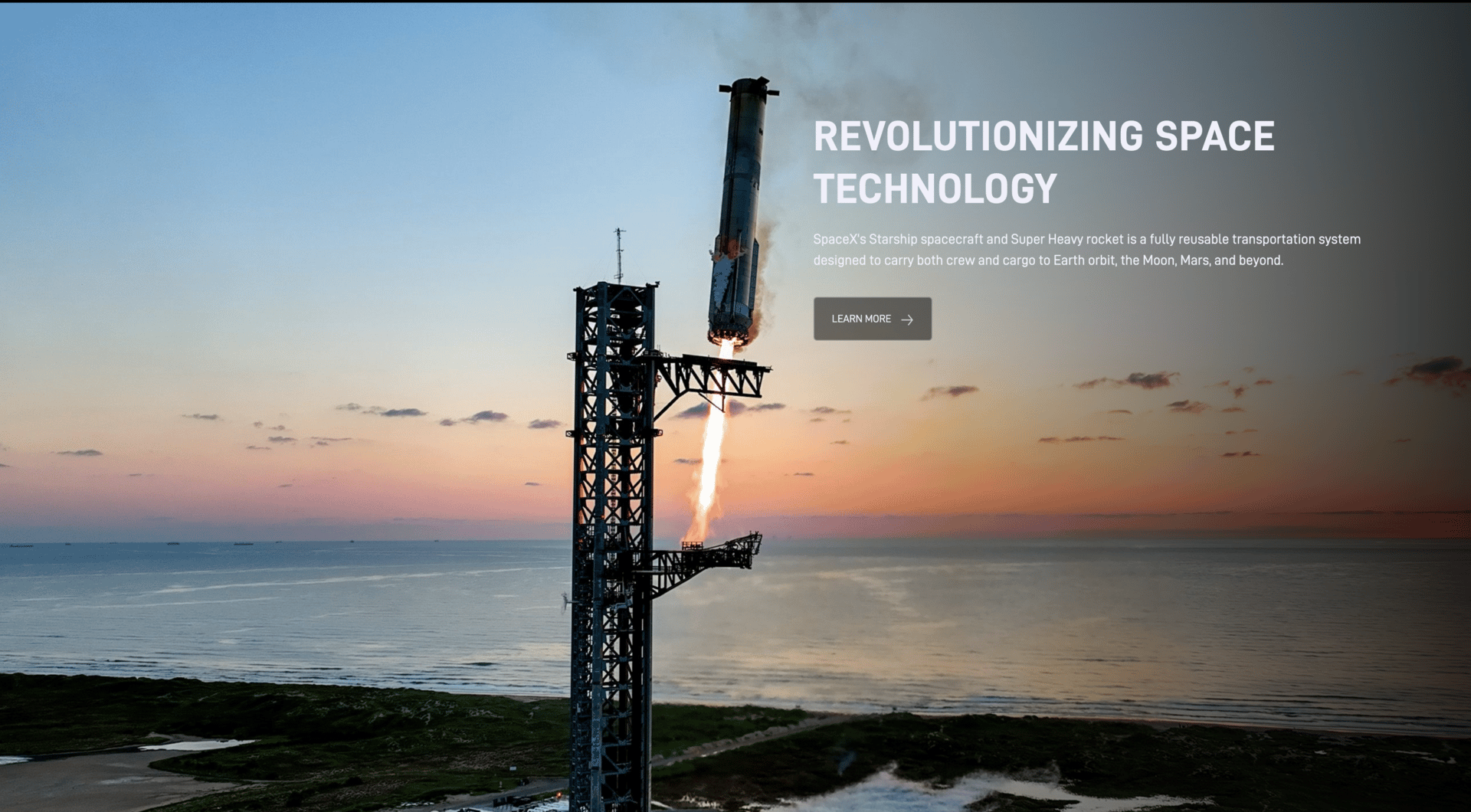

SpaceX just doubled its valuation to

$800 billion in six months.

Let me say that again: $800 billion. That's more than Boeing, Lockheed Martin, and Northrop Grumman combined. And it's still private.

Here's the thing nobody's talking about: while Elon's prepping for what could be the largest IPO in human history (targeting $1.5 trillion in mid-2026), most people are locked out of this opportunity completely.

The big institutions? They're already in. Baron Capital has a quarter of Ron Baron's personal wealth in SpaceX. Alphabet turned their $1 billion investment into over $8 billion. Fidelity, Sequoia, Andreessen Horowitz—they're all sitting pretty.

But you? If you're a regular investor, you're supposed to wait until the IPO, pay the $1.5 trillion valuation, and hope you're not buying at the top.

That's the old playbook.

Here's What Makes SpaceX Different

SpaceX isn't just launching rockets anymore.

They completed 170 orbital launches in 2025. That's more than every other country and company on Earth combined. Starlink hit 9 million subscribers and became cash-flow positive. They're talking about space-based AI data centers that could redefine cloud computing.

And get this: revenue is expected to jump from $15 billion in 2025 to $22-24 billion in 2026. That's not startup growth—that's rocket fuel growth (pun intended).

The kicker? SpaceX has a 10-year head start on reusable rockets. Blue Origin just landed their first booster a few months ago. SpaceX has been doing it for a decade.

The Problem (And How We Solved It)

Here's where it gets interesting.

While everyone waits for the IPO, there's a narrow window right now where you can get exposure to SpaceX at the $400-800 billion range through specialized investment vehicles.

Not at $1.5 trillion. Not after Wall Street takes their cut. Right now.

We partnered with Republic to bring this exact opportunity to our Founderscrowd Premium community. Through Republic's rSPAX Mirror Token, our members can gain economic exposure to SpaceX's performance at a reference price of $275 per share—based on the company's earlier valuation before the recent doubling.

Think about it: if SpaceX goes public at $1.5 trillion (nearly double the current $800 billion), early investors could see meaningful gains. If it trades even higher? Well, that's the opportunity.

Our Premium members are already positioning themselves. They're not waiting for the IPO circus. They're getting in while institutional money is still buying at these levels.

This Is Exactly Why We Built Founderscrowd

We started Founderscrowd because we were sick of watching regular people get locked out of the best investment opportunities while billionaires and institutions scooped them all up.

The venture capital playbook used to be simple: invest early, get rich. But that playbook was never available to you.

Until now.

Our Premium community gets access to pre-IPO opportunities, private market deals, and alternative investments that most people never even hear about. We do the research, negotiate access, and bring these opportunities directly to your inbox every week.

SpaceX is just one example.

📈 Want In?

Here's the deal: Founderscrowd Premium is normally $120/month, but we're still in beta pricing at $40/month.

For that, you get:

Weekly vetted investment opportunities (like SpaceX)

Full analyst reports and investment memos

Direct access to private market deals through our partnerships

A community of investors who actually get it

The SpaceX opportunity is live right now through our Republic partnership. But opportunities like this don't stick around forever—especially not with an IPO potentially six months away.

If you've ever felt like you're always one step behind the big money, this is how you change that.

Founderscrowd Premium gives you one fully analyzed investment opportunity every week, reviewed by our analysts and investment bankers.

Get access to pre-IPO companies, private market deals, and alternative investments most investors never see. $40/month (beta pricing, normally $120).

We're building something different. An investing community where regular people get access to the same deals that made Silicon Valley insiders wealthy.

No gatekeepers. No BS. Just real opportunities.

See you on the inside,

Alberto

Founder, Founderscrowd

P.S. The SpaceX IPO could happen as early as June 2026. That means the window to get in at pre-IPO valuations is closing fast.

Our Premium members are already positioned.

Are you?

Disclaimer: This newsletter is for informational and educational purposes only and does not constitute financial, investment, or legal advice. Investing in private companies involves significant risk, including the potential loss of principal. Past performance is not indicative of future results. The rSPAX Mirror Token does not grant equity, voting rights, or ownership in SpaceX. Please consult with a qualified financial advisor before making any investment decisions.

💬 QUICK HITS

🚀 SpaceX secondary shares reportedly trading at $350B valuation — Up from $255B in June 2025. Demand remains insane. More here [For premium members]

🤖 Anthropic reportedly in talks for Series G at $200B+ — Just 4 months after $183B Series F. AI lab valuations showing no signs of slowing. More here [For premium members]

💰 Databricks extends secondary window through Jan 15 — Last chance to buy at $62B before likely IPO in Q2 2026. More here [For premium members]