Good morning, Founderscrowd — and happy Wednesday!

It’s Alberto here. Hope you’re having a great week so far.

We’re diving into one of the biggest geopolitical updates of the year — and why it matters more than you think if you're investing in the private markets. Defense spending is going through the roof… and smart investors are already paying attention.

But first, let’s look at how the markets are doing 👇

Read time: 5 min 23 sec 🕒

📈 Market Pulse: The Rebound Is On

There’s some light breaking through the clouds this week. Global investors are breathing a small sigh of relief as tensions de-escalate in Europe and the Middle East. That means more clarity, and markets love clarity.

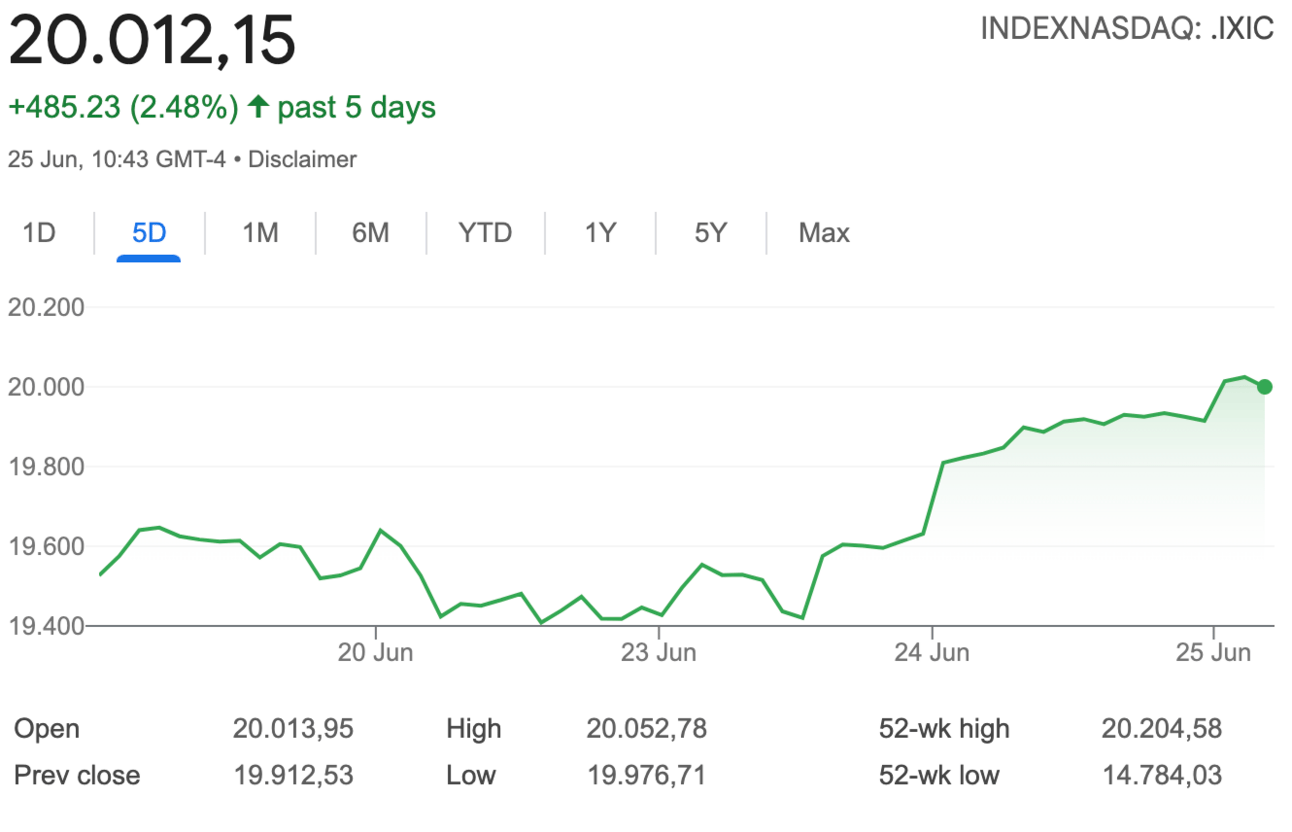

Here’s how the big three performed in the past 5 days:

S&P 500: 6,101.65 ⬆️ +1.90%

Nasdaq : 20,010.94 ⬆️ +2.48%

Bitcoin: $107,755.90 ⬆️ +4.28%

No one’s saying we’re out of the woods — but there’s a sense that worst-case scenarios (new wars, unpredictable alliances) are being contained. For investors? That means confidence is back on the table.

🛡️ NATO’s $1 Trillion Dollar Signal — and the Private Market Opportunity

On Monday, NATO countries officially agreed to raise their defense spending target from 2% to 5% of GDP by 2035.

That might sound like a bureaucratic policy move. But if you’re thinking like an investor, this is massive.

Let’s break it down:

The current NATO defense budget is roughly $1.2 trillion.

Raising targets from 2% to 5% would more than double that number in the coming decade.

Countries across Europe and North America are suddenly preparing to modernize, expand, and innovate across their military systems.

Why the sudden shift?

🧭 Rising global uncertainty — from Russia to China to cyber threats.

🧱 A push from the U.S. (and yes, Trump played a key role in the final agreement).

🚀 A growing belief that defense tech is no longer optional — it’s the new foundation of national resilience.

This is where it gets interesting for you and me.

🚀 The Private Markets Are Poised to Capitalize

For decades, the defense sector has been dominated by big public names: Lockheed, Raytheon, Boeing.

But with this new era of spending, countries will need more than jets and missiles. They’ll need:

Cybersecurity startups

Drone and robotics innovators

Intelligence, surveillance, and communications software

AI-driven supply chain logistics

Next-gen energy and climate-resilient infrastructure

These are the kinds of solutions being built right now by nimble, under-the-radar startups.

Historically, you’d need a badge from a VC fund to access those deals. But that’s changing — and this is where private markets come into play.

🧠 What This Means for You as an Investor

At Founderscrowd, we exist to give you access to the opportunities that used to be locked behind venture fund gates. Defense is no exception.

And this latest shift? It’s proof of how fast these categories are evolving.

As defense budgets soar, we’ll likely see:

More private funding rounds for defense startups

Accelerated exits (via M&A or IPO) for early-stage innovators

Strategic partnerships between startups and national governments

The window is opening, and those who understand the sector early may be able to capture value that institutional players haven’t even moved on yet.

This is exactly the kind of moment we live for at Founderscrowd. It’s what the private markets were built for: identifying breakout areas of opportunity before they go mainstream.

🔄 Let’s Wrap

This week’s NATO announcement is a big deal. It’s a $1 trillion signal that defense innovation is back at the top of the priority list — and private markets are likely to play a key role in the buildout.

And that’s what we do here. Every week, we show up with context, opportunity, and tools to help you invest smarter in private deals — before they become front-page IPOs.

Enjoy the rest of your week, and I’ll see you Sunday.

Alberto.

Founder,

@Founderscrowd

P.S. Like what you’re reading? Share this newsletter with a friend who’s ready to invest beyond the stock market.

Quotes from Bill Gates

“Success is a lousy teacher. It seduces smart people into thinking they can’t lose.”

“I choose a lazy person to do a hard job. Because a lazy person will find an easy way to do it.”

“We have to find a way to make the aspects of capitalism that serve wealthier people serve poorer people as well.”

“Be nice to nerds. Chances are you’ll end up working for one.”