I see you,

Alberto here, and I’m excited to bring you today’s special edition of the Founderscrowd newsletter! 🌟

I wanted to share something truly incredible with you—a story of resilience, rejection, and success that will not only inspire you but also get you thinking about your investment strategy.

The Canva Story: From Rejection to $40 Billion Success 🚀

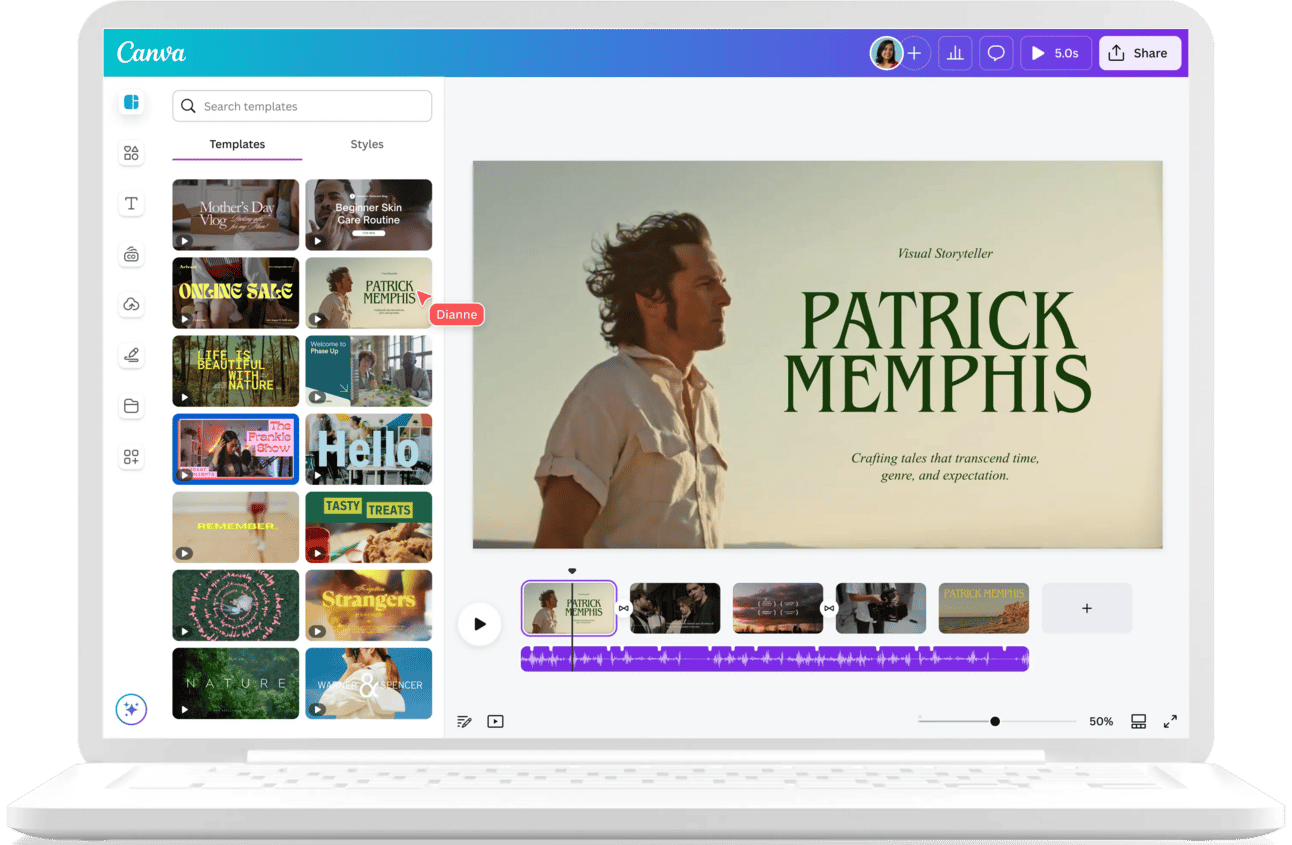

Meet Melanie Perkins, the founder of Canva, a platform that revolutionized the design industry and is now valued at an astonishing $40 billion. 🌟

Melanie’s journey is nothing short of incredible, and it’s a reminder that rejection is just the beginning of a success story.

Before Canva became the go-to platform for design, Melanie faced over 100 rejections from investors who didn’t believe in her vision. She wasn’t discouraged. In fact, each rejection fueled her determination even more. 💪

In 2012, after years of refining her idea and battling doubts from others, Melanie finally secured $3 million in seed funding. With this capital, she went on to create a global design platform that has empowered millions of users around the world to create stunning graphics, presentations, and marketing materials with ease. 🎨💻

But here’s the exciting part:

Today, Canva is a multi-billion-dollar company. And their revenue reflects that success:

Annual Revenue: Canva generates over $1 billion in revenue per year, with projections to continue growing rapidly. 📈

User Base: Canva has over 60 million active users across 190 countries, and they continue to grow rapidly as the go-to tool for both individual users and businesses. 🌍

Global Reach: Canva has expanded its product offering into over 100 languages and continues to add new features that drive even more users to their platform.

Flipping the switch from a small startup to a company generating over $1 billion a year in revenue is a massive success—especially considering Melanie had to convince investors time and time again that her product would work.

But here’s where the story gets even more exciting:

What If You Had Invested in Canva? 💸

Let’s talk numbers. Imagine if you had invested just $2,000 in Canva when they were raising their seed round back in 2012.

Today, with Canva’s latest valuation of $40 billion, that $2,000 would be worth over $1.6 million. Yes, you read that right—$1.6 million. 🤯

Canva’s impressive revenue growth and its expanding user base are just a few indicators of its massive potential. The design space is still evolving, and Canva continues to capture significant market share as it innovates.

A New Investment Opportunity You Don’t Want to Miss 🚀

It takes me a lot of time to find gems like this, but when I do, I want to share them with you. As part of the Founderscrowd community, you’re not just getting stories about entrepreneurs; you’re also getting exclusive investment opportunities that could have similar returns to stories like Canva’s.

I’ve found a startup with incredible potential—similar to the Canva story—and I’m sharing it with you all today. I won’t say much more right now, but trust me, you’ll want to check it out. Click below to learn more.

Today’s Fastest Growing Company Might Surprise You

🚨 No, it's not the publicly traded tech giant you might expect… Meet $MODE, the disruptor turning phones into potential income generators.

Mode saw 32,481% revenue growth, ranking them the #1 software company on Deloitte’s 2023 fastest-growing companies list.

📲 They’re pioneering "Privatized Universal Basic Income" powered by technology — not government, and their EarnPhone, has already helped consumers earn over $325M!

Their pre-IPO offering is live at just $0.26/share – don’t miss it.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

Stay tuned for more amazing stories and investment opportunities in the next edition of the Founderscrowd newsletter. As always, feel free to reach out with any questions or thoughts. I’m always happy to chat.

Thank you for being part of the journey. 🌍

Cheers,

Alberto

CEO, Founderscrowd

Guiding Founders, Inspiring Investors