Hope you are having a fantastic weekend.

It’s Alberto here, and today I want to share a powerful lesson in the world of early-stage investing—and how ordinary investors can now access opportunities once only reserved for top-tier players.

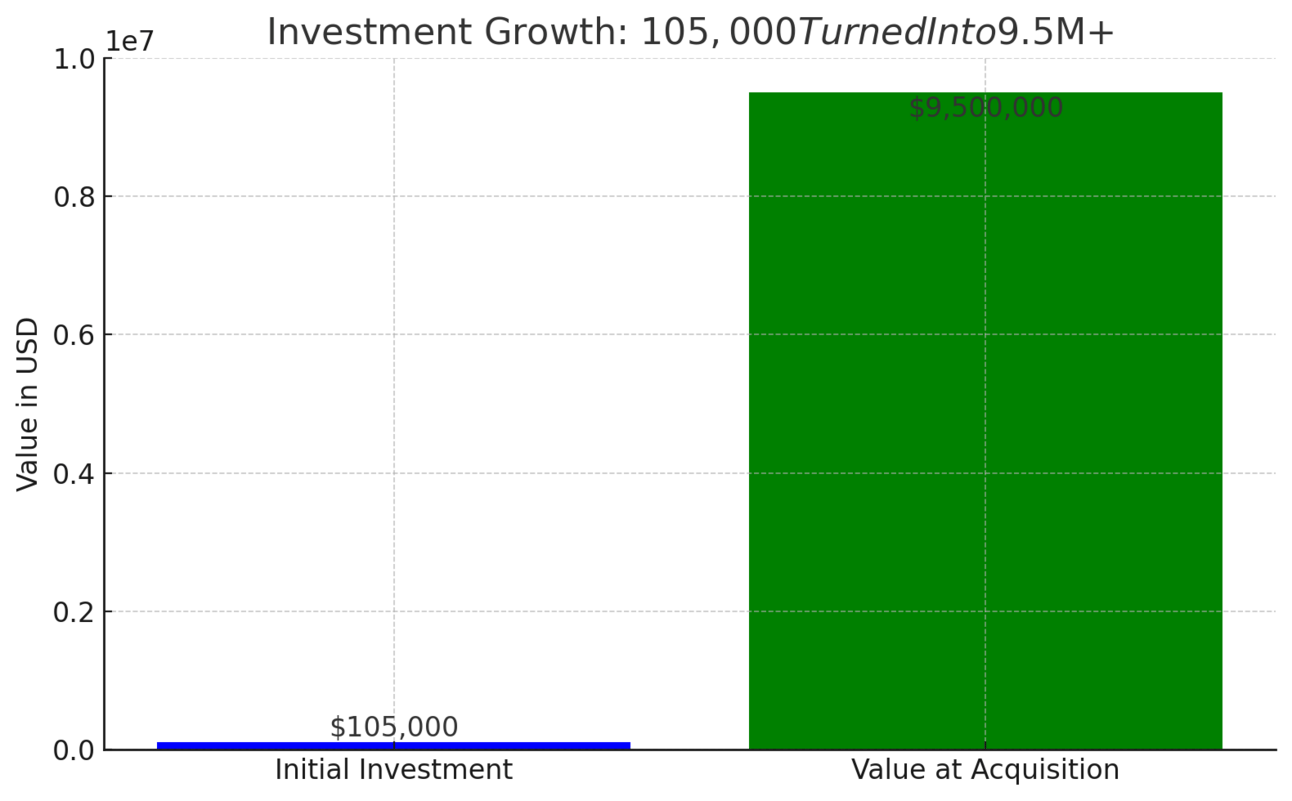

You’ve probably heard of Poppi, the gut-friendly prebiotic soda that just sold to PepsiCo for $1.95 billion. But what you might not know is that a group of angel investors and early-stage backers came together in 2020, putting in over $105,000 through a Special Purpose Vehicle (SPV) or a syndicate, to invest in Poppi when it was only valued at $22 million.

The Investment Math:

Here’s the magic of early-stage investing—the numbers speak for themselves.

Amount invested: $105,000 in 2020.

Valuation at the time: $22 million.

Acquisition by PepsiCo: $1.95 billion.

That $105,000 investment is now worth over $9.5 million! 📈

The Power of Early-Stage Investing

This story proves that timing and access to the right deals can completely transform an investor’s portfolio. Early-stage investors who got into Poppi when it was still a startup valued at $22 million saw massive returns when the company was acquired by PepsiCo for $1.95 billion.

Now, imagine being part of that group. If you had invested early on, your $5,000 would have turned into $450,000. That’s the power of investing at the right time and in the right companies. 🌟

Our Mission at Founderscrowd: Bringing Opportunities to You

At Founderscrowd, we’re on a mission to make these kinds of investment opportunities accessible to everyone—not just the top 1% or VC firms. These high-potential, early-stage opportunities are usually out of reach for everyday investors, but we’re here to change that.

We believe everyone should have the chance to invest in startups with the potential to change industries—just like Poppi did. That’s why we bring these opportunities directly to you.

Your Next Opportunity Awaits

Sound interesting? Poppi is just one example of what’s possible when early-stage investments pay off. We're constantly searching for the next big opportunity and bringing them to Founderscrowd. Whether you’re an experienced investor or just starting out, we’ll help you find the best opportunities that can generate meaningful returns.

This week’s opportunity? Check it below.

Apple's New Smart Display Confirms What This Startup Knew All Along

Apple has entered the smart home race with its new Smart Display, firing a $158B signal that connected homes are the future.

When Apple moves in, it doesn’t just join the market — it transforms it.

One company has been quietly preparing for this moment.

Their smart shade technology already works across every major platform, perfectly positioned to capture the wave of new consumers Apple will bring.

While others scramble to catch up, this startup is already shifting production from China to its new facility in the Philippines — built for speed and ready to meet surging demand as Apple’s marketing machine drives mass adoption.

With 200% year-over-year growth and distribution in over 120 Best Buy locations, this company isn’t just ready for Apple’s push — they’re set to thrive from it.

Shares in this tech company are open at just $1.90.

Apple’s move is accelerating the entire sector. Don’t miss this window.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

Thank you for being part of our growing community,

Alberto

CEO, Founderscrowd

Helping You Find the Next Big Thing in Startups.